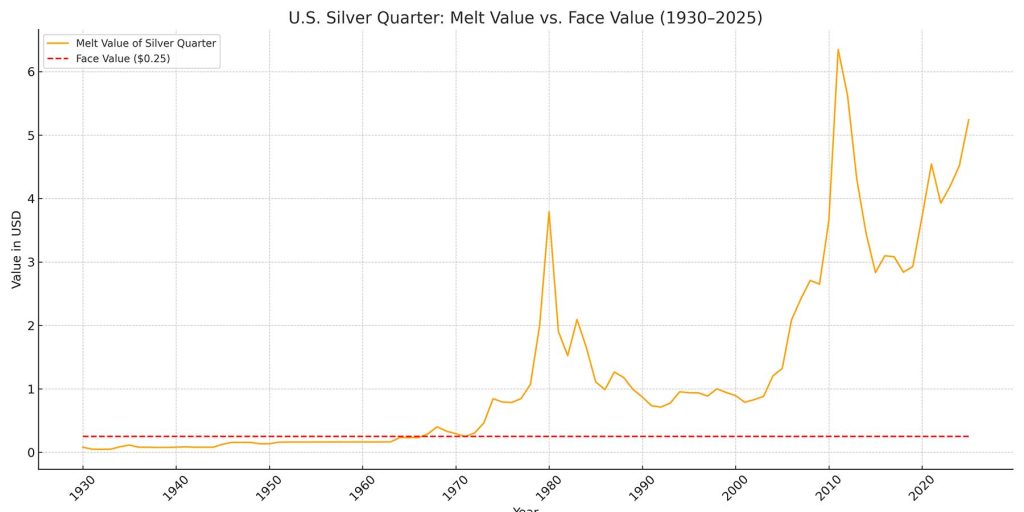

For much of U.S. history, real silver was part of everyday life. From the 1930s through 1964, the U.S. Mint produced quarters made of 90% silver—durable, valuable, and sound. But take a look at the chart below which shows the actual melt value of a silver quarter based on silver’s spot price from 1930 through 1964 compared to the face value of the common U.S. Silver Quarter with face value of $0.25.

For decades, these silver quarters traded for less than their melt value—sometimes as low as $0.06 worth of silver per quarter. That’s over a 300% premium on metal content! Yet, no one back then claimed that the coin was “overpriced” or that it failed as money. Why? Because people understood what we’ve forgotten today: the point of commodity-backed money isn’t that the melt value matches the face value. It’s that the backing limits the supply of money, and that’s what guards against inflation.

But when silver’s market value caught up with and eventually exceeded the quarter’s face value, the entire system collapsed. Silver coins were no longer profitable to mint. People began hoarding or melting them. By 1965, the U.S. ended the production of silver coinage—and abandoned any link between money and intrinsic value.

Fiat Currency: A System Without a Safety Net

When the U.S. removed silver and later gold from the monetary system, it ushered in the age of fiat currency—paper money declared legal tender by government decree, backed by nothing but confidence.

Since 1971, when President Nixon closed the gold window, the dollar has lost over 85% of its purchasing power. What cost $1 in 1971 now costs over $8. And the trend continues. Just look at the grocery store, housing market, or your energy bill. The root cause? Unlimited money printing.

Without a commodity backing, governments can expand the money supply at will. This benefits those who receive the new money first (banks, government contractors) but devalues the dollars held by savers and working families. It’s a hidden tax—inflation.

Why Silver and Gold Work Against Inflation

Silver and gold are not just shiny rocks. They are scarce, durable, divisible, and widely recognized—the four traits of sound money. Unlike fiat currency, they cannot be created out of thin air. Mining and refining metals takes effort, time, and cost.

- Silver has historically served well in smaller denominations for daily commerce. However, its relatively lower value per ounce made it vulnerable to being undervalued once inflation kicked in.

- Gold, by contrast, has always been the backbone of long-term wealth preservation. Its value is high enough that even a small quantity can represent significant purchasing power.

But both have one major challenge: portability and divisibility in everyday transactions. You can’t easily slice off 1/2000th of an ounce of gold to pay for a coffee—or carry a silver bar to the hardware store.

Enter the Goldback: A 21st Century Solution to a Centuries-Old Problem

Goldbacks solve the problems that ended silver coinage and eventually undermined the U.S. gold standard.

What is a Goldback?

A Goldback is a voluntary, local currency made with real gold. Each Goldback note contains a thin layer of 24-karat gold, embedded between layers of durable polymer. They come in denominations from 1/2 to 100, where a 1 Goldback note contains 1/1000th of a troy ounce of gold. Learn more about Goldback here: What is Goldback?

Unlike silver quarters or U.S. paper currency, Goldbacks do not have a fixed face value. Instead, they have:

- A fixed gold content (verified by weight).

- A floating exchange value, which adjusts with the gold market. (See historical exchange rate date here: Historical Data)

- A designed premium (usually 100%) to cover production and circulation costs—this premium also disincentivizes melting or misuse.

Why Is the Premium a Good Thing?

In the fiat world, premiums are often viewed negatively—something to avoid. But for Goldbacks, the premium is the feature that protects the system.

Let’s compare:

| System | Fixed Face Value | Fixed Premium | Market Tracking | Melt Risk | Inflation Protection |

|---|---|---|---|---|---|

| U.S. Silver Coinage | ✅ | ❌ | ❌ | ✅ | Partial |

| Fiat Currency | ✅ | ❌ | ❌ | ❌ | ❌ |

| Goldback Notes | ❌ | ✅ | ✅ | ❌ | ✅ |

Goldbacks float with the price of gold but maintain a consistent premium to ensure stability and usability. This means they can circulate for decades without becoming unprofitable to issue—or overly attractive to melt down.

The Goldback Advantage Over the U.S. Gold Standard

Many economists argue that returning to the gold standard would restore discipline to U.S. monetary policy. But a return to a government-run gold standard would also return us to the same vulnerabilities that doomed silver coinage and paper-gold redemption.

Goldbacks offer something better:

- Decentralized Value: Issued and used voluntarily in local economies.

- Tangible Asset: Each note contains real gold you can see and verify.

- No Government Dependency: Not reliant on the whims of central banks or Treasury policies.

- Scalable and Spendable: With ultra-fractional denominations (as small as 1/2000 oz), you can actually spend gold—something the classical gold standard could never do.

The Future of Money is Rooted in the Past — With a Modern Twist

The collapse of U.S. silver coinage wasn’t a failure of silver—it was a failure of monetary design. Fixing face values while ignoring melt value is a recipe for disaster. Fiat currency only worsened the problem by removing all ties to reality.

Goldbacks represent the evolution of sound money. By embedding gold directly into a spendable, flexible format—and allowing its value to float with market conditions—they strike the perfect balance between intrinsic value, usability, and economic integrity.

In a world awash with debt, inflation, and digital promises, Goldbacks are real money you can hold—and trust.

Convert your fiat currency into Goldback today by purchasing Goldback’s from our preferred partner Defy the Grid by clicking here.

Disclaimer: Royal Leo Holdings, LLC and GoldbackInfo.com are not registered financial advisors. All content on this site is provided for informational and educational purposes only and represents our own opinions—not financial advice. You should consult a qualified professional before making any investment decisions.

0 Comments